Rolling into the Base

ZOLL Billing has the ability to roll itemized charges into the base rate (also called lumping). When you set this feature as a payer requirement, itemized charges will be rolled into the base rate. For example, if your base rate is 1100, you can combine the itemized charges resulting in a base rate of 1300. While billing in this fashion is not common, ZOLL Billing gives you this option if needed.

Enable rolling into the base

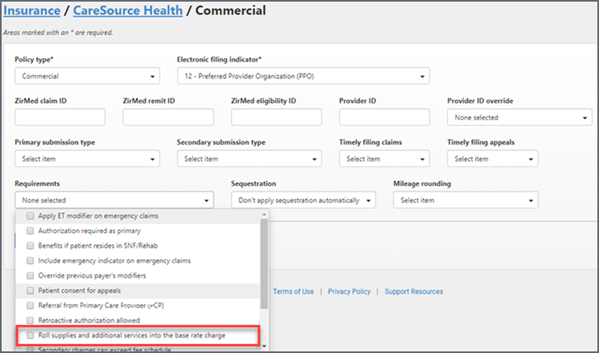

Rolling into the base rate is a payer requirement set at the Policy or Benefit plan levels. To enable it:

- On the navigation bar, click Payers.

- On the Payers page, click the payer name. To search for a payer, enter the payer's name into the box under the title.

- You can turn on rolling into the base from the policy or benefit level by clicking on the Requirements field and selecting Roll supplies and additional services into the base rate charge.

A couple things to note before you get started:

- Mileage and non-covered mileage is always a separate line item and is never rolled into the base rate.

- For Medicare and flat rate contracts, the CO-45 will increase by the amount of the rolled charges.

- Rolled charges will always get a zero dollar payment from Medicare. They are technically paying you those in the base rate so they will not pay those.

On the Claim page

You can view active charges and submitted charges for rolled charges on the Claim page.

Submission history – past submitted charges

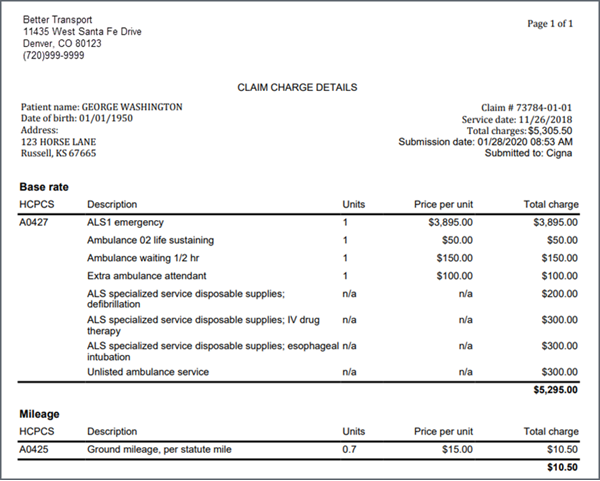

Once you submit the claim, click the "Submission history" tab to view the claim’s charges. There will be an entry for each claim submission in ascending order.

$ Charges: Use the Claim Charge Details page to justify your base rate when requested to do so by a payer. It includes your company’s name, the name of the patient as well as the claim and charge details. If the payer asks you to justify your base rate charges, print this out and send it to them.

Charges tab – active charges

This tab displays the active charges on the claim. The "Print charge details" link opens a page in a separate tab that shows a list of active charges – charges that are currently on the claim. This printout could be different from the one under the "Submission history" > "Charge details" if changes were made to the charges after the claim was submitted and the claim was not resubmitted to the payer. In other words, the current charges are different from the submitted charges.

Working with contracts

If you have a contract with a payer and you are rolling charges into your base rate, when you post a payment to the claim the system will take the percentages defined in the contract and divide up the remainder of the payment across each incidental charge. You can see how this works by going to the Claim page and clicking the Credits and "Running claim balance" tabs. Here you will see the percent of the remaining payment applied to each HCPCS that was rolled into the base rate.

Medicare and rolling into the base rate

Medicare will always pay only a base rate and mileage based on the fee schedule. You don't have to change the requirement field to include rolling into the base rate - this setting is done for you. In addition, the system will not distribute the payment to any charge other than the base rate or mileage. With Medicare, you cannot charge the customer for any ancillary supply charges. The video shows more detail on how this works with Medicare.